The Series A Bust

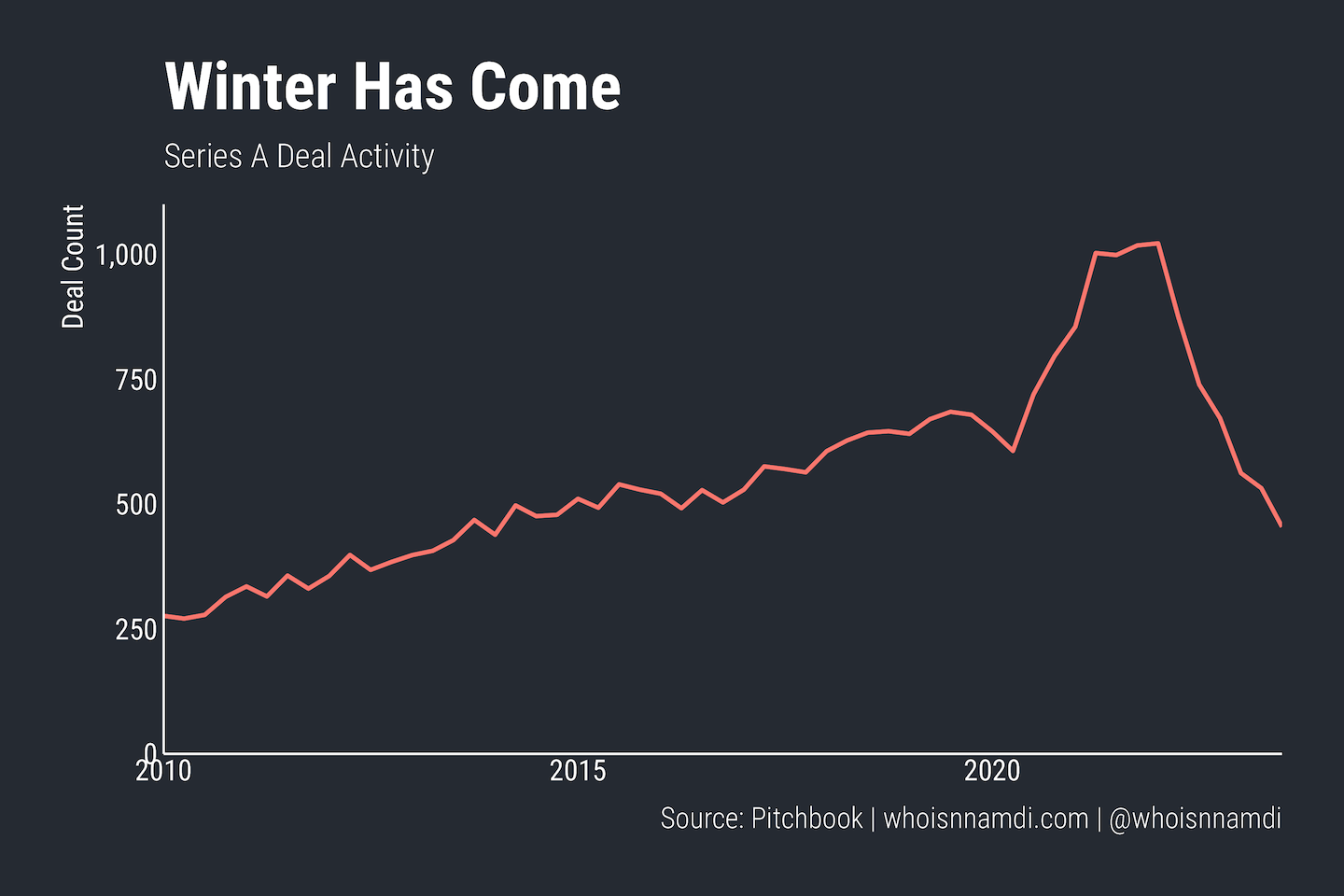

It's cold out there in Series A land:

A common explanation for the Series A winter is raised expectations – investors are demanding to see better metrics and traction. Most companies don't meet this new, higher bar, hence fewer deals get done.

While certainly true, this can't be the whole story. Only if we look at Series As in a vacuum does this explanation seem comprehensive. Incorporating what's happening in the rest of the market, however, there's a much richer narrative to explore.

The bigger picture? In addition to raising their expectations for Series A, investors have lost faith in Series A as a sign of product-market fit.

Series A investors expect more but believe less.

Receive my new long-form essays

Thoughtful analysis of the business and economics of tech

Relatively speaking

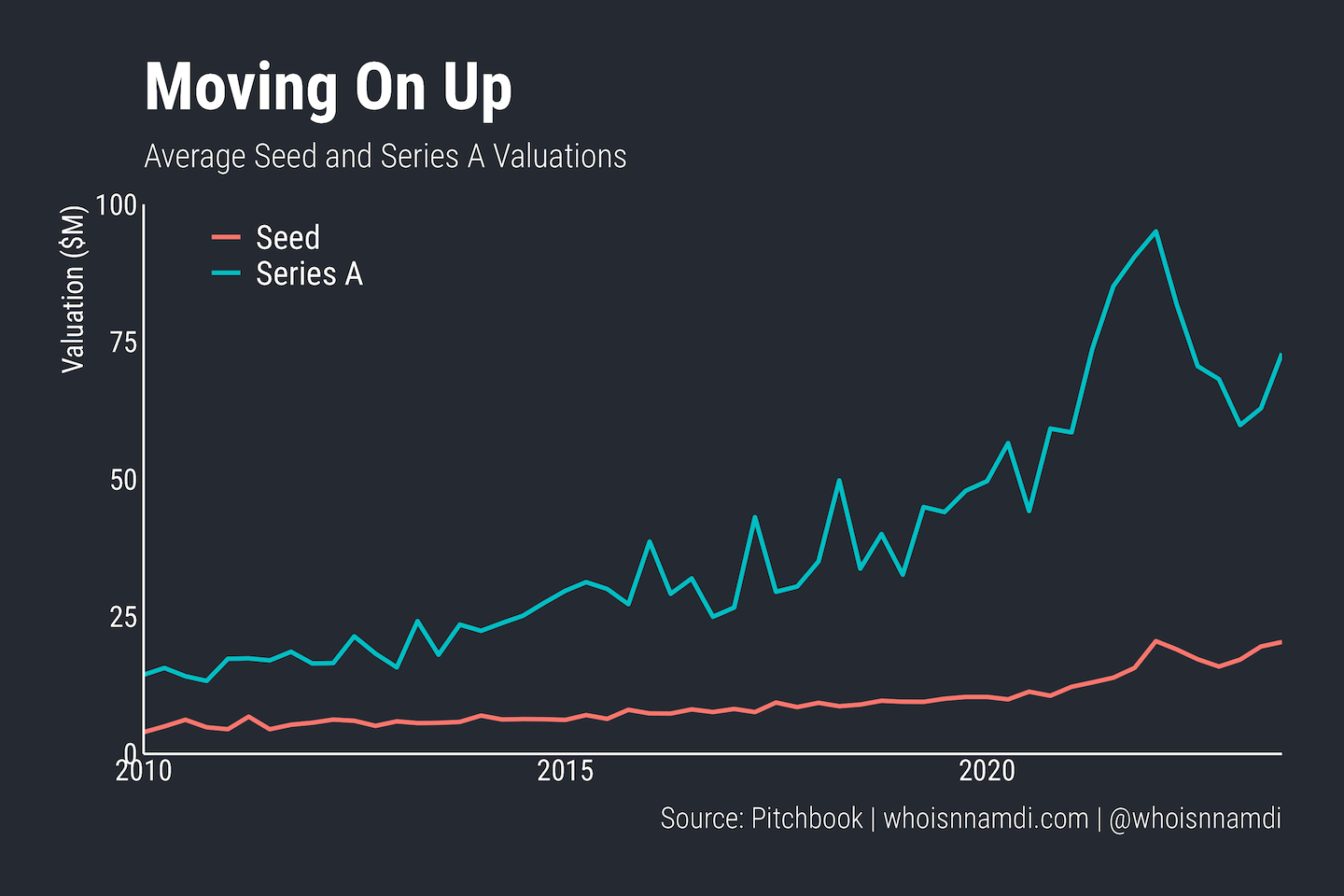

Valuations for both Seed and Series A stage companies rose dramatically over the last decade or so of venture:

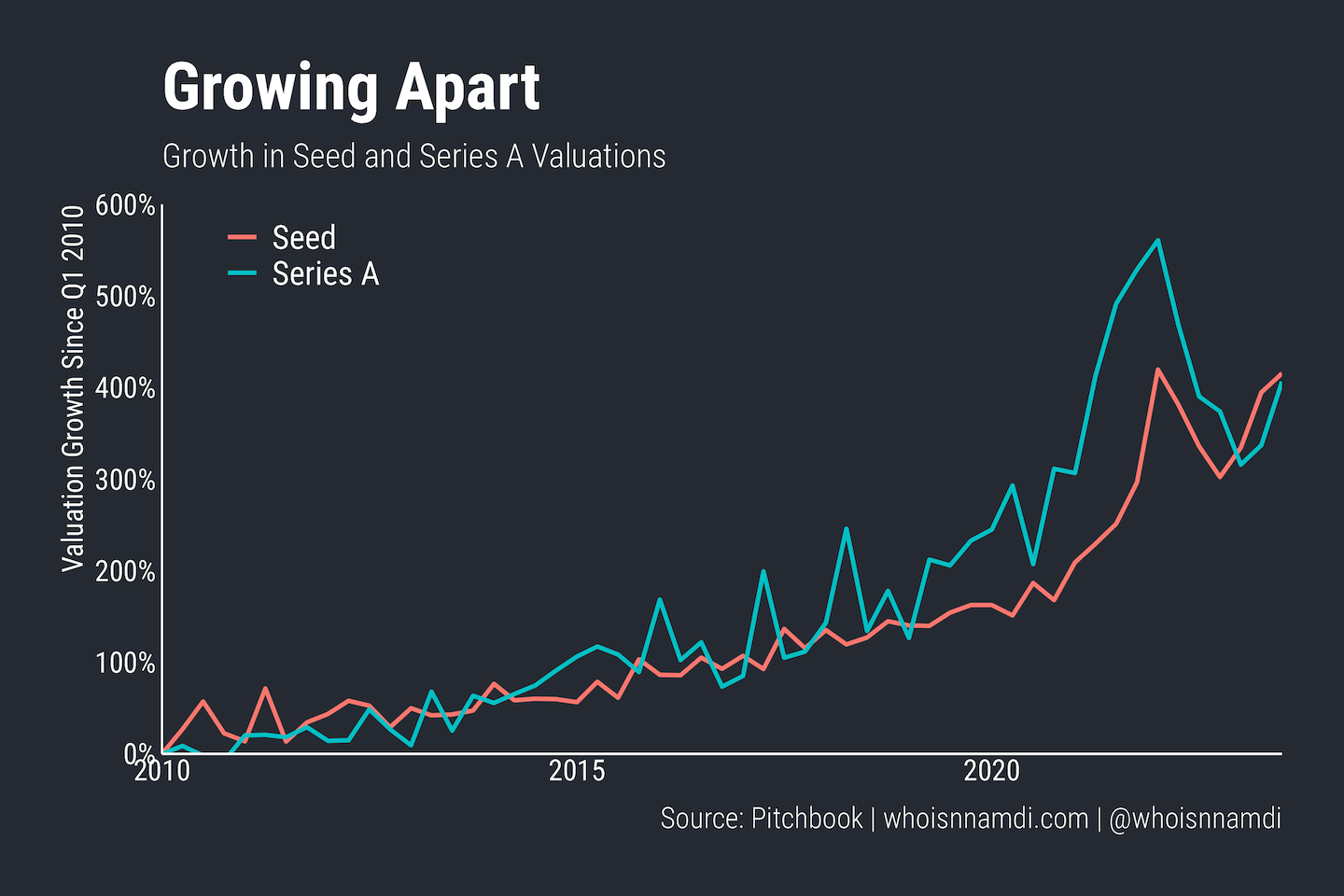

The appreciation in Series A valuations seems extreme relative to that of Seed deals. Of course, the scales here are different, so we'd do better to baseline these to the same starting point and track the growth over time:

While the two grew roughly in line for the first few years, Series A valuations began to accelerate around 2017. That acceleration sustained itself until the recent fall off in venture valuations.

Notably, both Seed and Series A valuations are recovering. That's a small point in favor of the "raised expectations" story – investors are funding higher-quality businesses, deserving of stronger valuations.

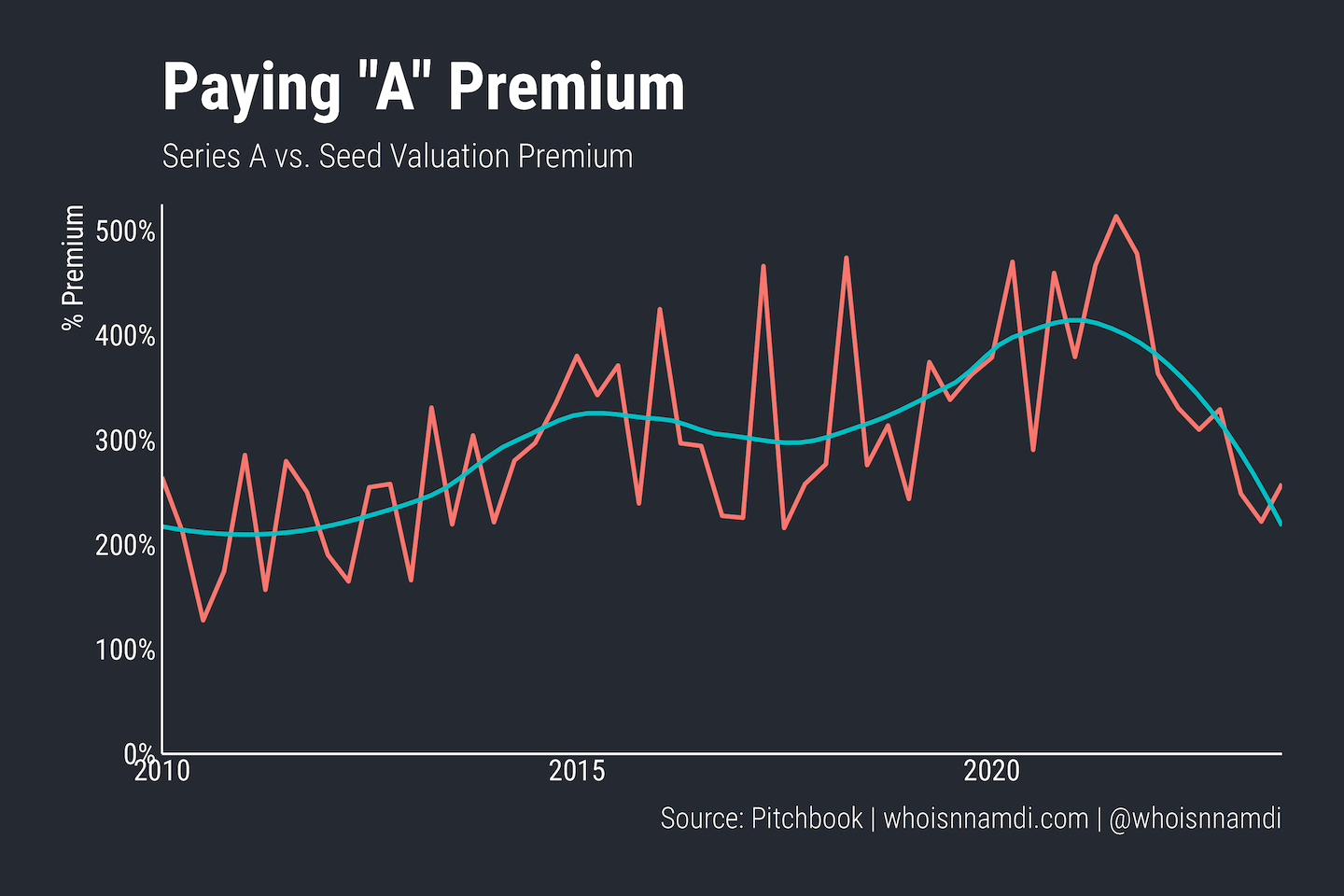

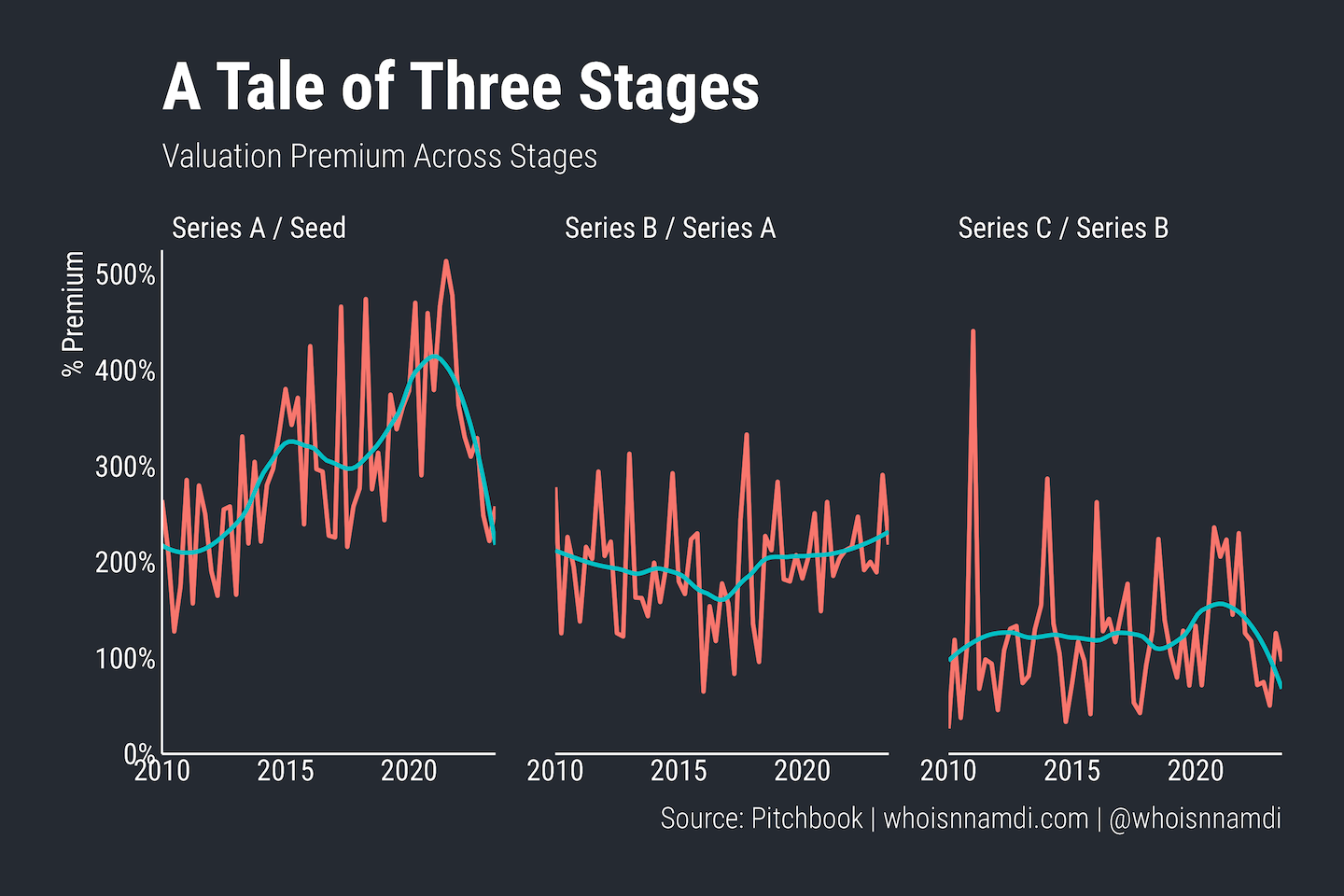

Here's where the expectations story starts to lose its luster. Below I plot the valuation gap or "premium" for Series A relative to Seed, along with a flexible trend line to remove noise:

- From 2010 to 2014, the two grew roughly in line, with Series As being priced 200% higher or 3x Seed rounds

- Then, Series A valuations accelerate relative to Seeds to a 325% premium or 4.25x multiple

- In 2019, the Series A premium spikes again, peaking in late 2021 at 500% or 6x

- Things collapse after that, ending in Q3 2023 at 2010 levels

If investor expectations told the full story, Series A valuations relative to Seed deals would be higher today. Since Seed investments remain speculative and standards have risen for Series A investment, we'd expect the typical Series A to be even more valuable relative to Seeds, reflecting higher quality. Instead, the gap has compressed.

It's been quite the rollercoaster ride. Notably, this rollercoaster is unique to Series A / Seed. We don't see remotely the same behavior in the premium between later rounds:

The premium for Series B vs. A and the premium for Series C vs. B are both much more stable over time, with little trend once you remove the noise. The Series C / B premium saw a slight bump during the exuberant 2021 days, but that was short lived:

- The Series B / A premium has been roughly 200% for the entire period

- The Series C / B premium hovers around 125% with few exceptions

For whatever reason, the way investors value Series A companies relative to Seed stage companies has fluctuated substantially over time (slowly rising and then suddenly falling), while their views on relative value in later stages have held steady.

Why?

Series A University

What is different about graduating from Seed to Series A than going from Series A to B, Series B to C, etc?

There are many potential explanations, but the one that jumps out to me is some notion of product-market fit (PMF) and business de-risking. Series A companies tend to have much better PMF than Seed companies, in a way that's distinct from Series B relative to Series A, and so on.

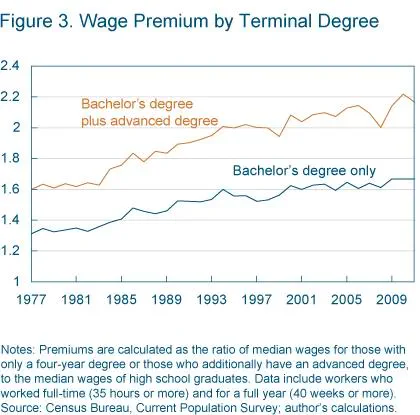

Think about it like higher education – a college degree is a signal of one's skills to the labor market. Employers value them accordingly. Further, a college degree means more relative to not having one than having a graduate degree means relative to having only an undergraduate education. Again, employers value them accordingly:

While the probability of a company achieving PMF is certainly not 100% at the time of Series A (many companies raise Series A before that), it's definitely much higher at the A round than at the Seed round, since it's effectively 0% at that point.

Startup risk reduces materially once a company graduates to Series A. In a way, that's exactly why a startup successfully raises its Series A – the founders have de-risked the business, so much so that an investor is willing to invest substantial capital, take a board seat, etc.

If we posit that the "price" or "value" of PMF is well-proxied by the Series A / Seed premium, we can think of this premium moving over time due to fluctuations in the supply (among startups) and demand (among investors) for PMF:

- A rising price typically indicates either contracting supply – the relative supply of startups with PMF vs those without – or growing demand – the relative demand for post-PMF startups vs pre-PMF startups

- Importantly, these are relative concepts – the number of pre and post-PMF startups could be both growing over time, but if the number of pre-PMF startups is growing faster, that would imply a relative decline in PMF supply

$$\text{Relative Supply of PMF} = \frac{\text{Supply of Post-PMF Startups}}{\text{Supply of Pre-PMF Startups}}$$

So what explains the pre-2022 run up in the Series A / Seed premium: declining (relative) supply of PMF or rising (relative) demand for PMF?

My argument: rising demand for PMF.

First, as I've argued elsewhere, the growth and development of the venture ecosystem has been a mostly demand-side story. That should strongly bias us toward the demand explanation:

Investors are the primary driver of fluctuations in venture activity and equity prices around their long-run trend – We Don't Have Nearly Enough Startups

The venture ecosystem is supply-constrained – there isn't nearly enough startup equity out there to satisfy investor demand.

Additional capital drives opportunistic company formation at the Seed stage. However, the additional capital doesn't improve survival to the later stages – it simply drives prices up for the remaining companies – It's Valuations (Almost) All the Way Down

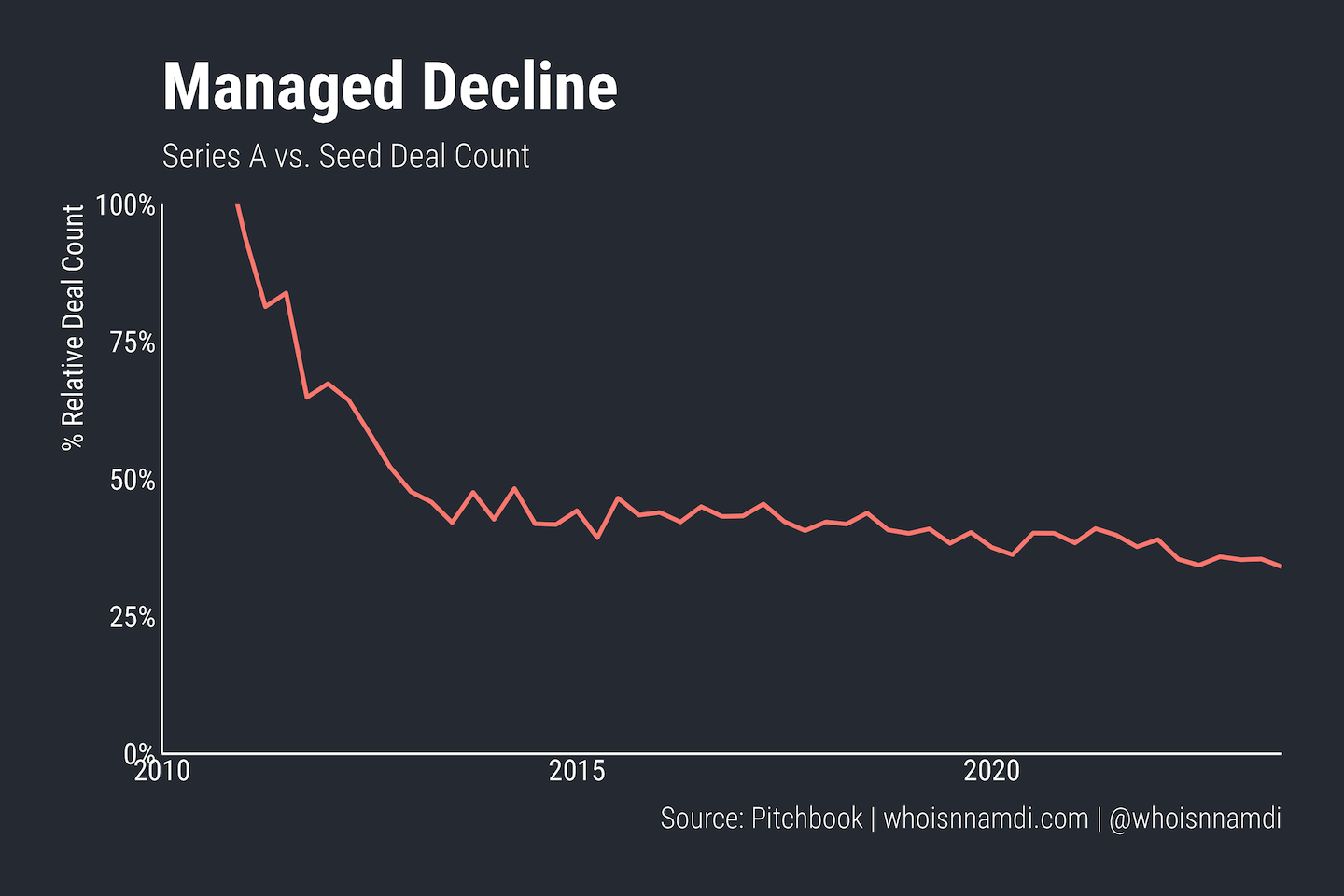

Second, the ratio of Series A to Seed transactions has been reasonably stable since about 2014. It's declining somewhat (Seed rounds are growing slightly faster than Series As) but not nearly as rapidly or vigorously as relative prices have moved. In fact, it's remarkably consistent, even through the ups and downs of the last few years:

- Seed activity (the denominator) exploded through 2014, bringing down the ratio (A long time ago, Series As were more common than Seeds)

- The Series A vs Seed ratio stabilized thereafter, only slightly falling over the years

My read: this is evidence of stable relative supply of pre vs. post PMF companies. More often than not, when quantities are steady (as in the chart) and prices are rising, it's due to constrained supply rather than constrained demand.

So, investor demand for de-risked companies rose substantially, driving higher relative prices for Series A companies. Meanwhile, the supply of such opportunities didn't grow to match that, so we didn't see a dramatic change in Series A relative to Seed activity.

Busted

Ok, so we have a plausible story for everything that happened up until the 2021 market peak. But things obviously turned after that. For my theory to be credible, it has to offer some explanation for the recent downturn that fits the data.

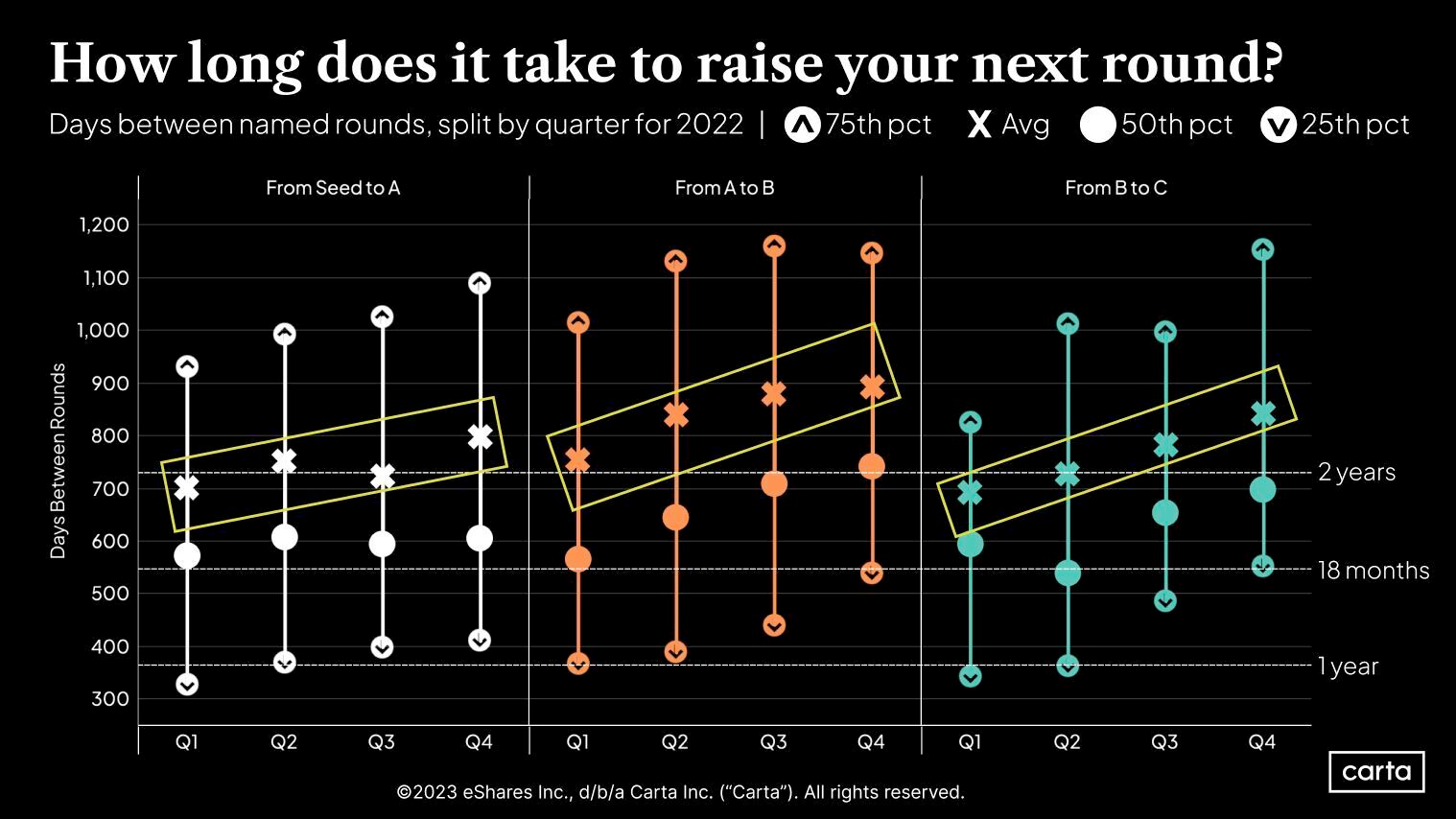

Speaking of data – everything we've looked at thus far is from the perspective of the overall market. But individual companies and founders don't experience the aggregate, they live their own particular trajectory, raising subsequent rounds spaced apart rather than at the same time. A founder looking to raise Series A cares about how the market looks 18-24 months after they raise their Seed:

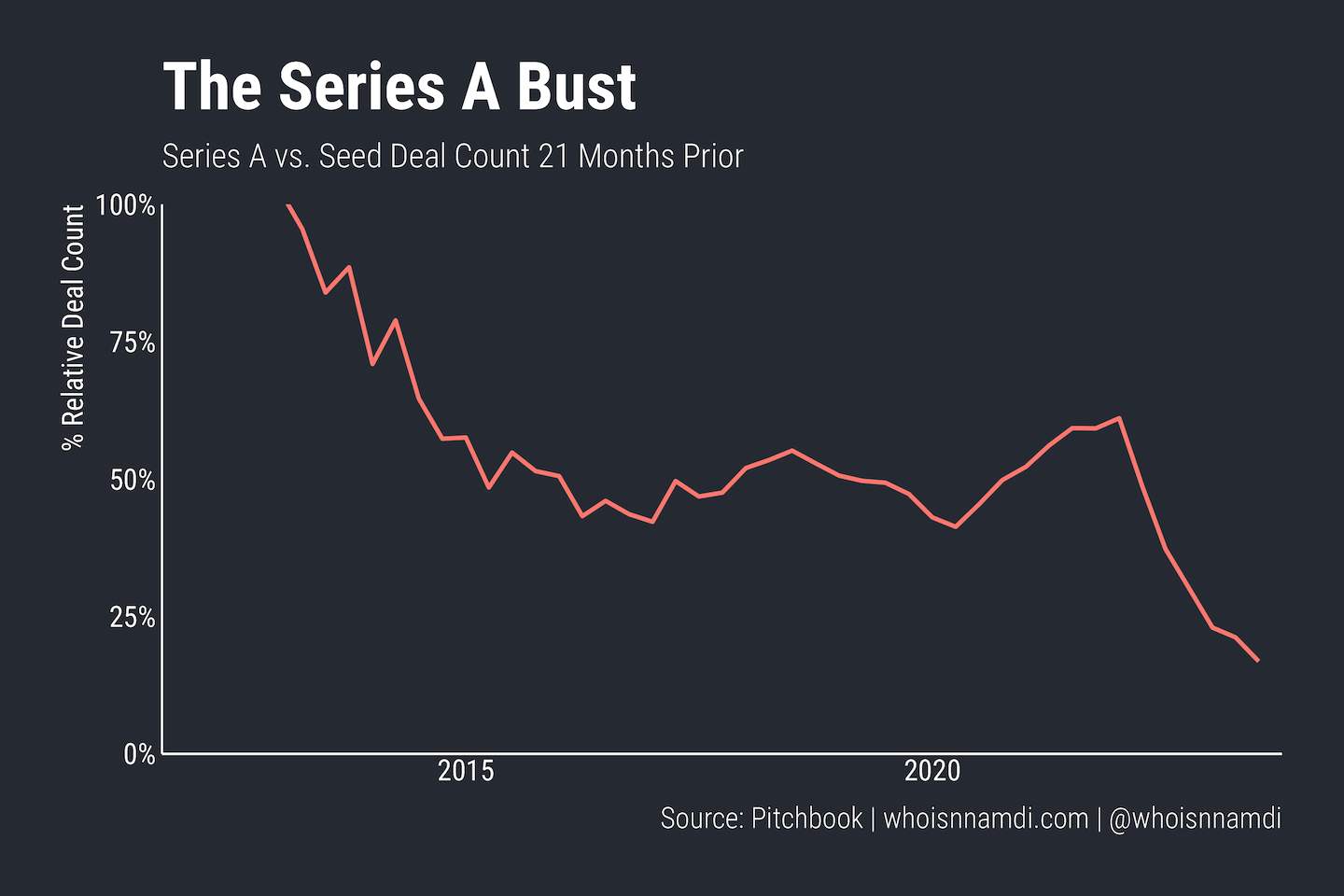

Let's take the founder perspective and compare Series A deal activity to Seed activity 21 months prior, a reasonable (median) estimate for the time it takes to raise that next round. Think about it as a rough proxy for the Seed to Series A "graduation" or "survival" rate. Not every Series A was preceded by a Seed financing, so this is more of an upper bound for the graduation rate:

- From 2014-2020 it's a very similar picture to what we looked at before, a stable "graduation rate"

- Conditions improve substantially in 2020, i.e. more Seed companies survive to the next round

- However, post 2021 the graduation rate collapses to the lowest levels ever seen, ~20%

So, while the ratio of Seed to Series A deals at any particular point in time has been stable, due to the timing discrepancy (founders raise their Series A some time after the Seed), the numerous startups that raised Seed funding during the boom are now facing a massive bust. Ironically, though 2021 was the "best" time to raise a Seed based purely on venture activity and valuations, it was the "worst" time to raise Seed funding once you account for today's tough Series A environment.

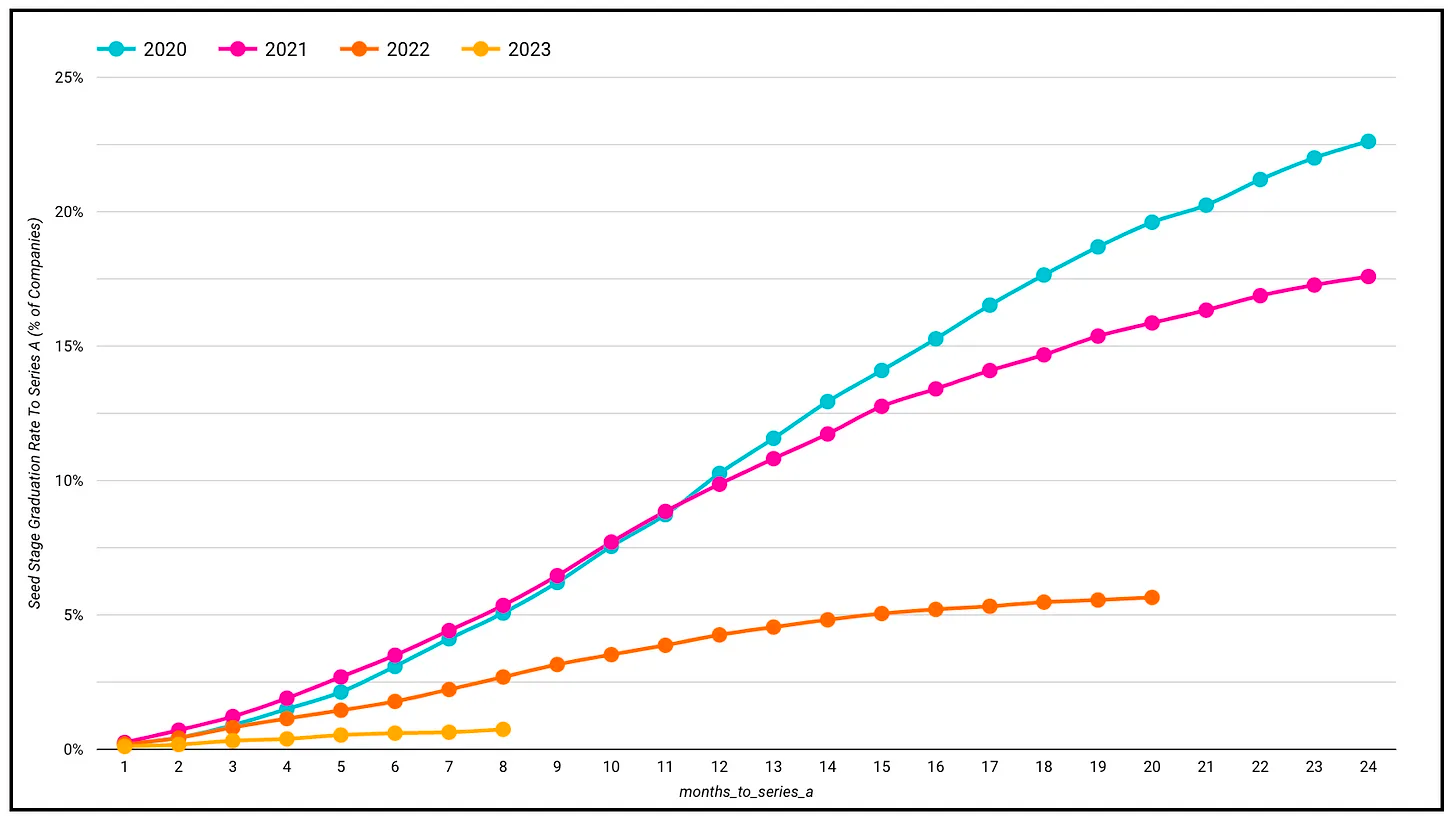

This simple analysis doesn't accurately identify the "level" of the graduation rate, but it proxies the "change" over time. It's safe to say the graduation or survival rate from Seed to A has fallen by more than half. Other sources like Charles Hudson, Jamesin Seidel, and Carta corroborate this:

Decline in Graduation Rate from Seed to Series A - Historically, we've seen a strong pipeline of companies moving from seed to Series A. Recent numbers, however, indicate a significant decline in this graduation rate. Measured graduation rates will continue to fall for several quarters as companies go out for and fail to raise Series A rounds. Graduation rates from seed to Series A could drop to 25%, or one-third or one-half of what they were at the peak. – The Big Reset in Seed to Series A Graduation Rates is Real and Permanent

Back in 2020, approximately 23% of Seed-stage startups made it to Series-A within two years. Fast forward to 2022, and the market looks different. Over the past 20 months since the start of 2022, the graduation rates have decreased to 5%. – A Deep Dive into Q3 2023's Funding Landscape

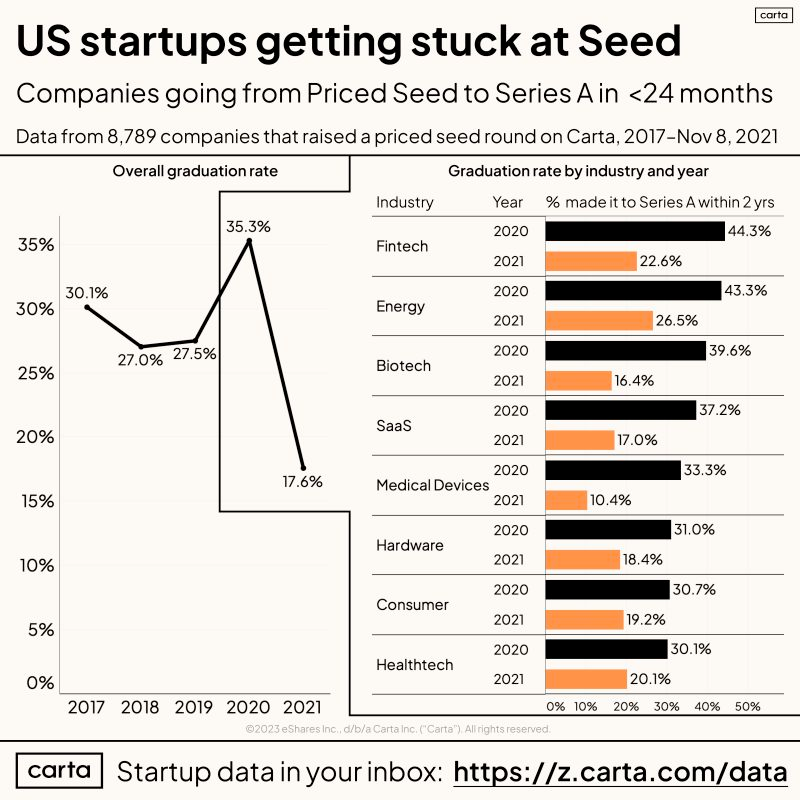

The percentage of companies who make it from seed to Series A within two years fell by a lot for the 2021 seed cohort.

27.5% of companies that raised a seed round in 2019 made it to Series A within 2 years.

Only 17.6% of companies who raised their seed in 2021 have "graduated" to the next round. – Peter Walker on LinkedIn

How does my theory explain this data? Put simply, venture investors re-assessed their beliefs about Series A companies. They no longer see Series A as a substantial indicator of product-market fit, given so much risk still remains. That's why their relative price has fallen off.

This is different in subtle ways from the common "Series A investors have raised their expectations" narrative:

- If it was only about loftier expectations, the Series A premium would have risen, since only the best companies would be getting funded, and those companies would fetch a high price.

- That's not what we see – relative prices have fallen, not risen.

Investors haven't only raised their expectations; they just don't see Series A as indicative of PMF to begin with. If they did, the relative price of Series A companies would still be elevated. Instead, they no longer see the point in paying up for them.

Again, return to the education analogy:

- If the college wage premium plunged, we'd say employers no longer see the college-educated as having "labor market fit". In other words, they lost faith in the college degree as a signal of quality in the labor market

- You would not intuitively connect this to rising employer expectations (though that could certainly be true too)

So sure, investors raised their expectations – you need more revenue to raise your Series A, more users, etc. But the bigger factor is that investors' beliefs about Series A changed.

Investors today expect more but believe less.

If the product doesn't fit, you must acquit

I have abused the expression "post-PMF". The reality is most companies do not achieve product-market fit by their Series A, and that's always been true. But that's my entire point – investors have wizened up to the fact that Series A companies still have material risk.

PMF is more fleeting than we all had appreciated. Series A valuations corrected to reflect this.

Balance has returned to the Force. Maybe that's a good thing. But it's dreadfully volatile if you're living it in first-person as a founder. The Series A market got the wind knocked out of it just as the large 2021 Seed cohort came up for air.

While it's a tough time for founders, I think it's important to be clear-eyed about the reality of the situation. The bar has been raised, but further, investors are questioning the bar as a meaningful indicator of success in the first place.

So yes, your first priority is still to raise that next round, but there's still much work to be done thereafter. More so than ever, Series A does not mean you have product-market fit. Investors don't believe it and neither should you.

Receive my new long-form essays

Thoughtful analysis of the business and economics of tech