Layoffs Don't Tell the Whole Story

Layoffs grab headlines. Hiring freezes, less so.

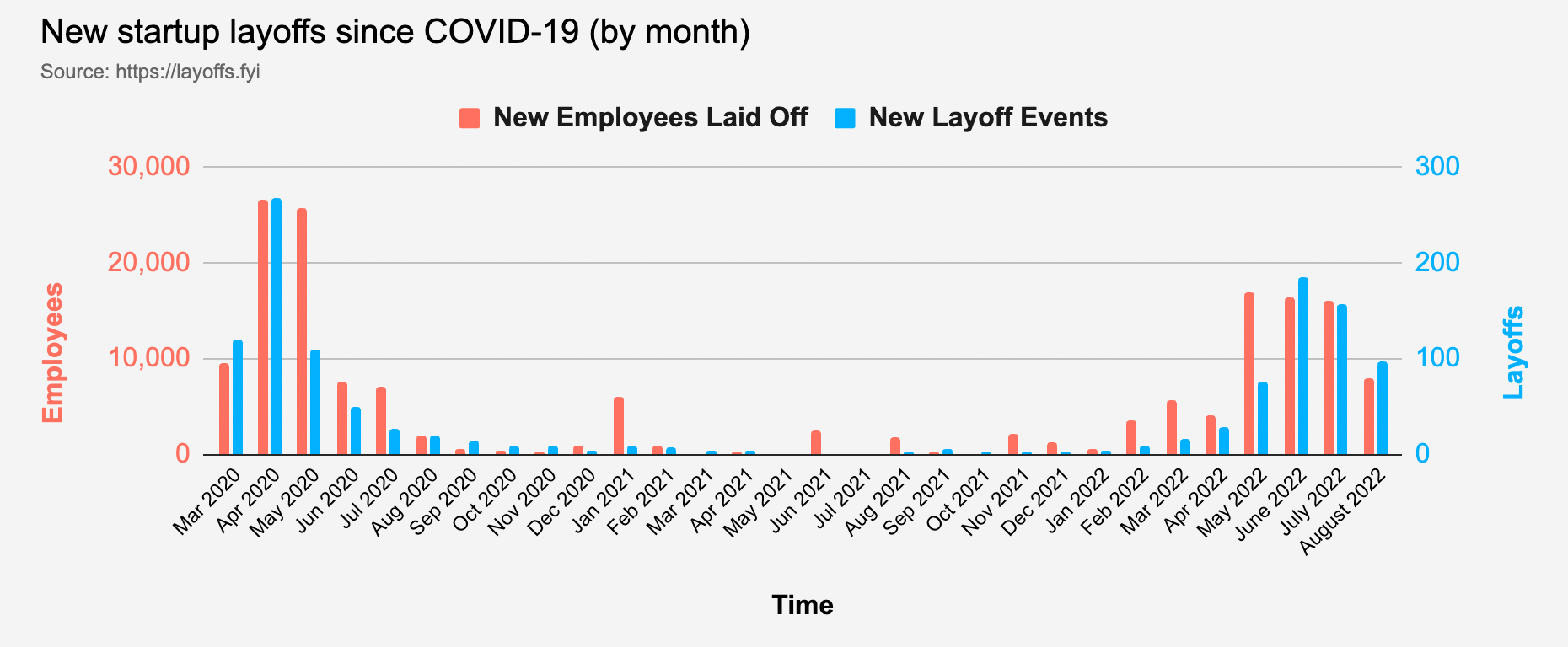

Sites like layoffs.fyi track layoffs in gory detail, as do journalists and tech writers:

Large layoff rounds in tech, sadly, are still on.

— Gergely Orosz (@GergelyOrosz) July 20, 2022

Olive AI let go ~30% of staff. They were one of the biggest unicorns in the Midwest (valued $4B)

Capsule (digital pharmacy startup, valued >$1B) had large layoffs. I'm still not sure of the exact % here (feel free to DM)

However, it's slow hiring, not layoffs, that most drives unemployment.

Layoffs don't tell the whole story.

Receive my new long-form essays

Thoughtful analysis of the business and economics of tech

Stocking up

Employment and unemployment are both "stocks".

Stocks are quantities measured at a point in time that change over time. For example:

- The volume of water in a lake

- The stock (hint hint) of inventory in a retail store

- Cash on a company's balance sheet

On the other hand, "flows" are rates of change of a particular stock. For example:

- Water from various rivers flowing (hint hint) into a lake

- Shipments of new inventory

- A startup's monthly burn rate

A single stock can have multiple associated flows, and the sum total of these flows determines how the stock changes over time.

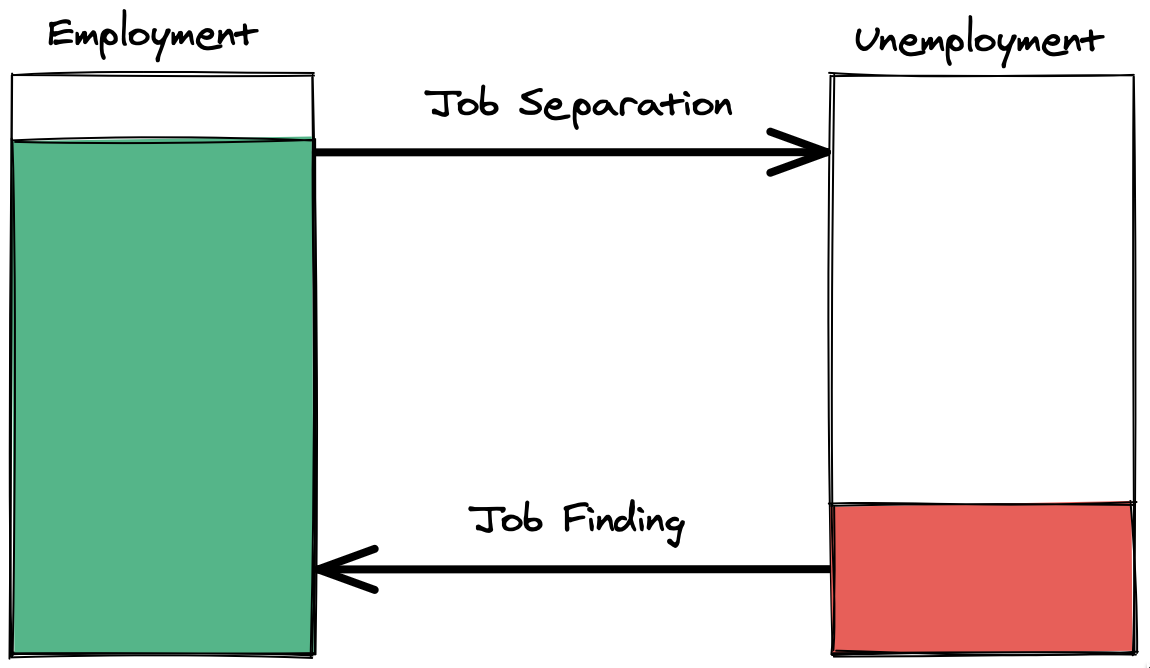

In the labor market, workers flow between employment and unemployment (stocks) at various rates (flows):

In equilibrium, the various stocks of a closed system are stable. However, if the individual flows change, the related stocks change too:

- During recessions, flows from employment to unemployment (job separation) increase, while the flows out of unemployment into employment (job finding) decrease

- Vice versa for recoveries – people find jobs more quickly and fewer people get laid off in the first place

In this way, variation in job separation and job finding "explain" changes in unemployment.

As the labor market cools, hiring freezes

We commonly associate unemployment with layoffs. During recessions, we imagine heartless employers suddenly laying off droves of workers:

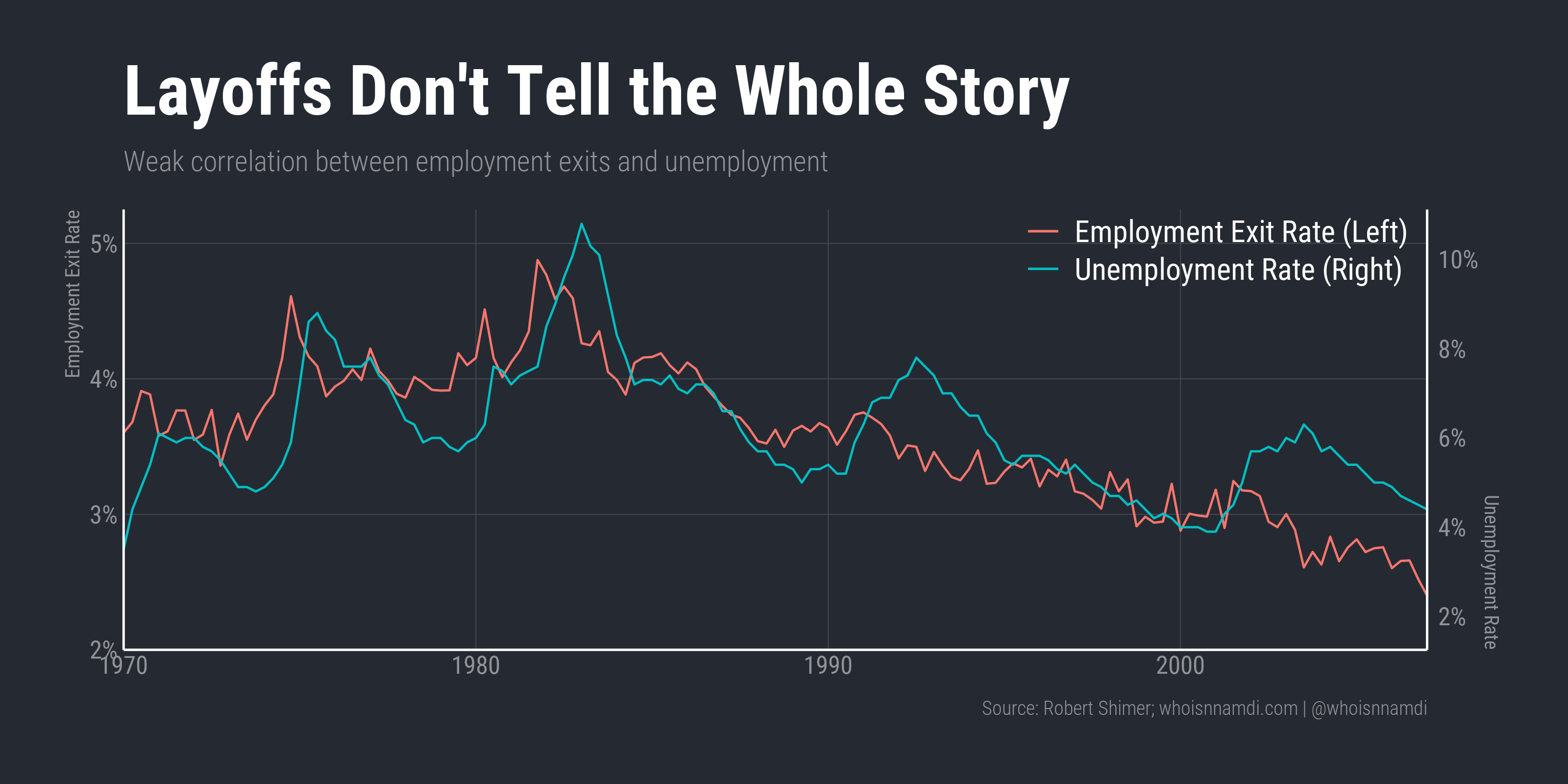

While this story feels intuitive, the data doesn't bear this out.

The below chart plots the U.S. "employment exit rate" (a euphemism for layoffs or voluntary quitting that ends in unemployment) along with the unemployment rate itself. Think about the exit rate as the share of all employed workers who leave employment each quarter:

Employment exits jiggle up and down at a much higher frequency than unemployment, and the timing of those short term fluctuations doesn't align well with granular movements in unemployment. Over longer periods though, they do seem loosely connected.

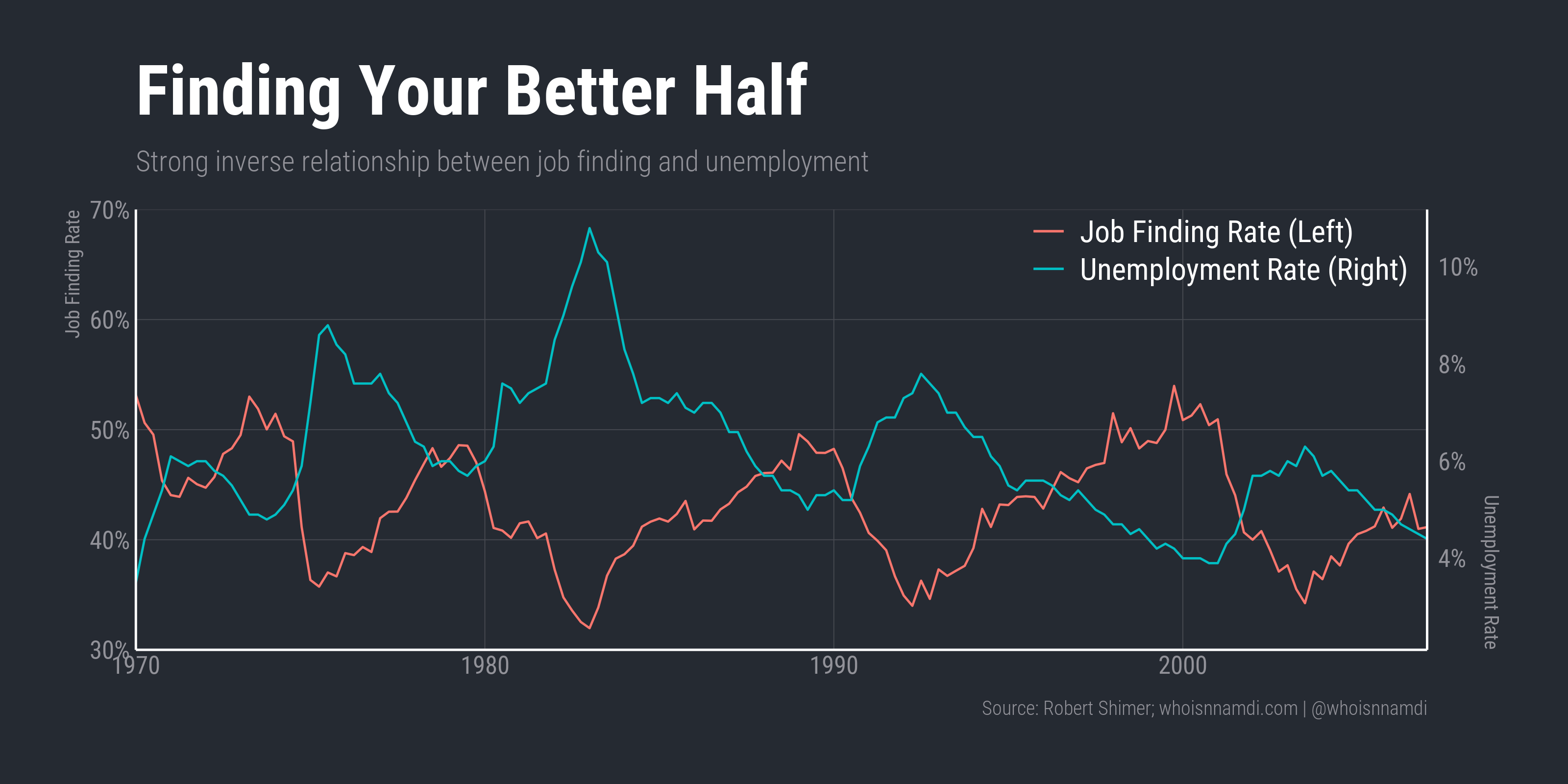

Now let's look at the other piece of the puzzle. Here, I've swapped out employment exit for the "job finding rate," i.e. the proportion of unemployed workers who find a job each quarter:

The lines perfectly mirror each other.

The fluctuations closely track the state of the economy. When job finding plummets, unemployment rises at the same time. As the economist Robert Shimer put it:

… a decline in the job finding rate… contributed to every increase in the unemployment rate during the post-war period – Reassessing the Ins and Outs of Unemployment

As the job finding rate slowly recovers, so does unemployment.

So, rather than massive layoffs defining recessions and spikes in unemployment, the more powerful explanatory story is one of hiring freezes – employers simply stop hiring during recessions.

Per our stocks-and-flows model, the stock of unemployed workers grows and shrinks primarily due to variation in the outflow from unemployment to employment rather than the inflow of employment to unemployment.

In other words, hiring freezes are the real story, not layoffs.

Hiring or firing?

What's the relative importance of hiring freezes vs layoffs?

Here's how we can estimate this:

- Let's say we hold variable A constant and allow variable B to move around. If unemployment still moves around a lot then we know most of its variation is driven by variable B

- Similar logic applies in the opposite scenario (allowing A to fluctuate while holding B constant)

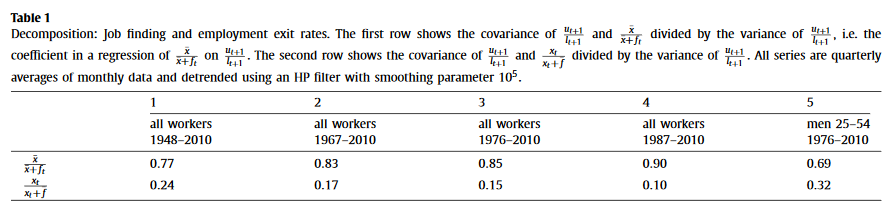

This table quantifies the relative contributions of job entry and exit rates to overall unemployment variability by calculating counterfactual scenarios in which either variable is held constant while the other is allowed to fluctuate. The first row holds job separation constant and the second holds job finding constant (Source):

The result?

... since 1987, including the recessions in 1990–1991 and 2001, and 2008–2009, the job finding rate accounted for virtually all fluctuations in the unemployment rate – Reassessing the Ins and Outs of Unemployment

The job finding rate explains the vast majority of variation in unemployment, and the proportion has only increased over time.

From 1987 to 2010, variation in the job finding rate explained 90% of the variance in unemployment, while employment exit only explained 10%.

Here's Shimer again:

The bulk of the reason unemployment rises and stays high throughout the recovery is because the unemployed workers stay unemployed for longer…

This is precise, quantitative evidence for the overwhelming importance of hiring over firing in explaining unemployment.

Hyper-(de)growth

If the prior data seemed counterintuitive, the following example shouldn't.

Imagine you're a high-growth startup with big ambitions to grow the employee base in the coming year:

- You are currently 100 employees

- You want to hire an additional 100 people over the next year

- We ignore voluntary attrition just to keep the numbers simple

Suddenly, the environment changes:

- Economic conditions worsen, capital gets tighter, you start to miss plan, etc

- You need to make cuts, both in the current employee base and the future one

- So, you lay off 20% of the team

This is extremely painful, demoralizing, and controversial, only made easier by the fact that everyone else is doing it too:

My sense is that it's partly - "if we layoff people at the same time everyone else does, it'll look more like bad market conditions were to blame and less like we've ran this thing poorly"

— Nnamdi Iregbulem (@whoisnnamdi) May 5, 2022

i.e. if everyone stampedes at the same time, no one is to blame for trampling anyone

You also institute a hiring freeze, which only seems fair after laying off so many team members:

3. Immediately re-hiring after layoffs paints the picture of leadership of what it is:

— Gergely Orosz (@GergelyOrosz) July 8, 2022

Incompetent.

Couldn't even figure out what % of people to lay off.

It doesn't take an HR savant to realize you aren't going to hit your original 200 headcount target for next year.

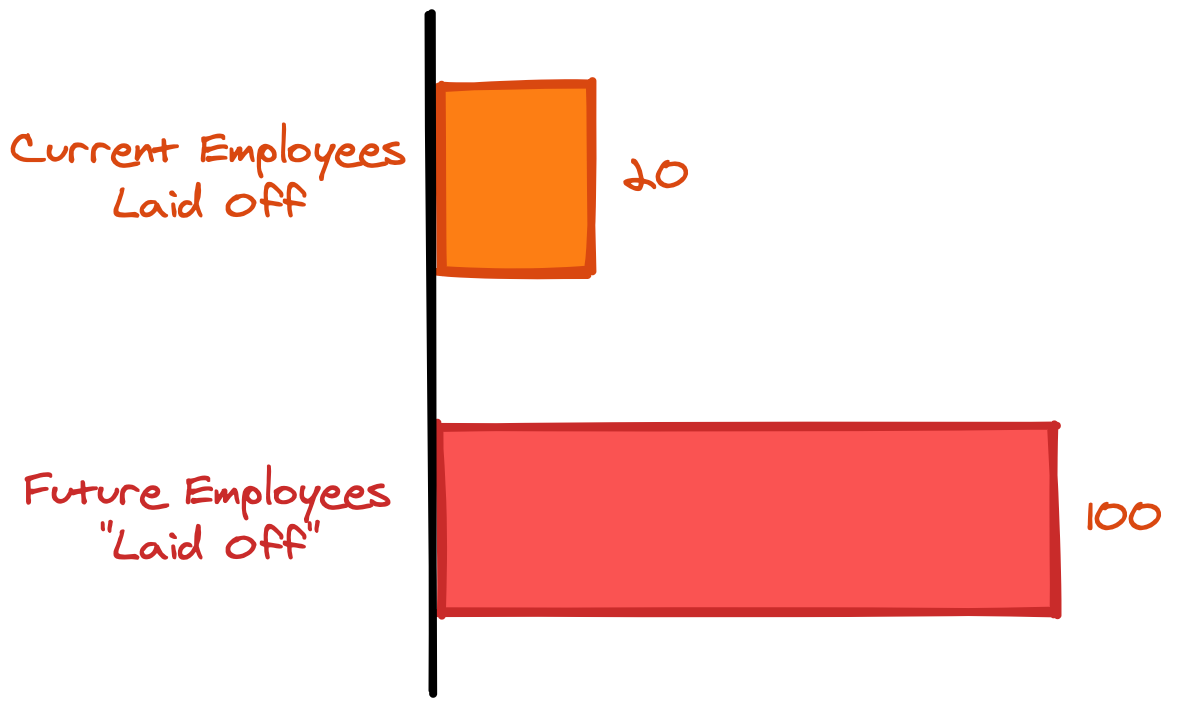

Now do the gap analysis – between layoffs and slowed hiring, which is more responsible for missing the original headcount target?

It's the hiring freeze of course!

- You laid off 100 x 20% = 20 people

- Meanwhile, you cut the hiring plan from 100 to zero

In effect, you "fired" or "laid off" 100 future employees while only laying off 20 current ones:

As one founder friend whose recent layoff was leaked on social media told me:

Sure, the layoff news leaked, but when we modeled this stuff out we realized it's the reduced hiring that would save us the most cash.

A hiring freeze is a much bigger story, even if the media only reports layoffs:

- Internally, management knows the hiring freeze will have a larger impact on team velocity (and, frankly, cash burn) than the layoffs.

- Yet externally, everyone will focus on the layoffs.

This misses the raging forest fire for the merely singed trees.

A new perspective

Recognizing the importance of hiring freezes should change your focus regardless of whether you're a founder or an employee.

As a tech worker:

- The biggest risk you face in an economic downturn is not so much losing your current job but instead being unable to find a new one (due to hiring freezes)

- In addition, as you assess the viability of various startups, pay equal, if not more, attention to slowed hiring at the company than highly visible layoffs

- When interviewing, ask about the hiring plan and how it's changed in recent quarters

If you're a founder:

- Slowed hiring is the real sign of weakness and vulnerability in your competition

- Even with no layoffs, your competitors could be in a dire financial straits, necessitating a complete freeze in hiring

- If you're well-capitalized, your biggest opportunity during a downturn isn't picking up people who were laid off (though you should definitely consider this) but rather hiring the people your competitors would have wanted but now can't due to hiring constraints

Lay off the layoffs

Layoffs are a noisy estimate of company performance:

- Layoffs are tainted with worries about public perception and internal morale, making otherwise troubled companies hesitant to do them

- Companies conduct layoffs during downturns in part because everyone else is doing it, and they know they won’t look as bad if they move with the herd

Hiring freezes are a clean signal of a viability and confidence of management:

- Few companies would cut back on their hiring plans simply to fit in

- If anything, knowing others are pulling back makes companies more aggressive in hiring

That said, hiring freezes are opaque from the outside:

- Outside of large organizations, most never publicly announce hiring freezes

- In many cases, hiring freezes aren't even openly discussed internally outside of the core executive team and the board of directors

Keep in mind both the seen and the unseen. It's easy to focus on the shock and awe of layoffs, but you miss so much in doing so.

Layoffs aren't even half the story – they're 10% of it.

Receive my new long-form essays

Thoughtful analysis of the business and economics of tech