High Retention = High Volatility

"With great retention comes great volatility" – Uncle Ben in Spiderman

OK – that's not exactly what Uncle Ben said, but it makes an important point: retention is a double-edged sword.

Higher retention means customers stick around and pay you longer. Customers paying you more over time is even better.

Improving retention increases the value of your business, all else equal.

However, higher retention also drives higher valuation volatility.

The reason is clear to anyone who’s ever traded bonds.

Cohort Math = Bond Math

A cohort of customers can be likened to financial security – a bond paying you some amount periodically, perhaps indefinitely.

This “interest rate” fluctuates – it changes over time. Some customers cancel, churning out, and others maintain or even increase the size of their subscription, paying more over time. Positive churn implies these payments decline over time, while negative churn implies the opposite.

A bond has some value associated with it, which is roughly equal to the present discounted value of all the future payments from the bond.

This value varies inversely with the effective interest rate or yield of the bond. Similarly the value of a stream of cash flows varies inversely with the discount rate applied, or in the case of a company, its cost of capital.

This sensitivity to interest rates increases with the tenure of the bond. In others words, the value of a 30-year bond is more sensitive to interest rates than that of a 10-year bond.

In finance, this concept is called duration. Duration measures the sensitivity of the value of a bond to a change in interest rates, which is tied to the lifetime of the bond. Bonds with longer tenure or back-loaded cash flows are more sensitive to changes in interest rates.

Due to the multiplicative nature of discounting, the present value of far-away payments is more sensitive to a change in interest rates than the value of soon-to-come payments.

This is exactly the situation companies with high retention face.

Receive my new long-form essays

Thoughtful analysis of the business and economics of tech

Cohort Lifetime = Bond Duration

With higher retention, more and more of the value of an acquired customer comes from its later years of life.

Again, the present value of these later years is more sensitive to changes in the discount rate applied to the cash flows, due to the compounding of discounting.

Since all companies are on some level simply a collection of various customer cohorts with variable and fixed costs layered on, the summed value of the individual cohorts determines the overall company's valuation.

Hence, the better your retention, the more sensitive and volatile your valuation is to changes in your discount rate or cost of capital. This contrasts with a high-churn company where customers last only a few months or years.

Let’s break out the spreadsheet and prove this to ourselves:

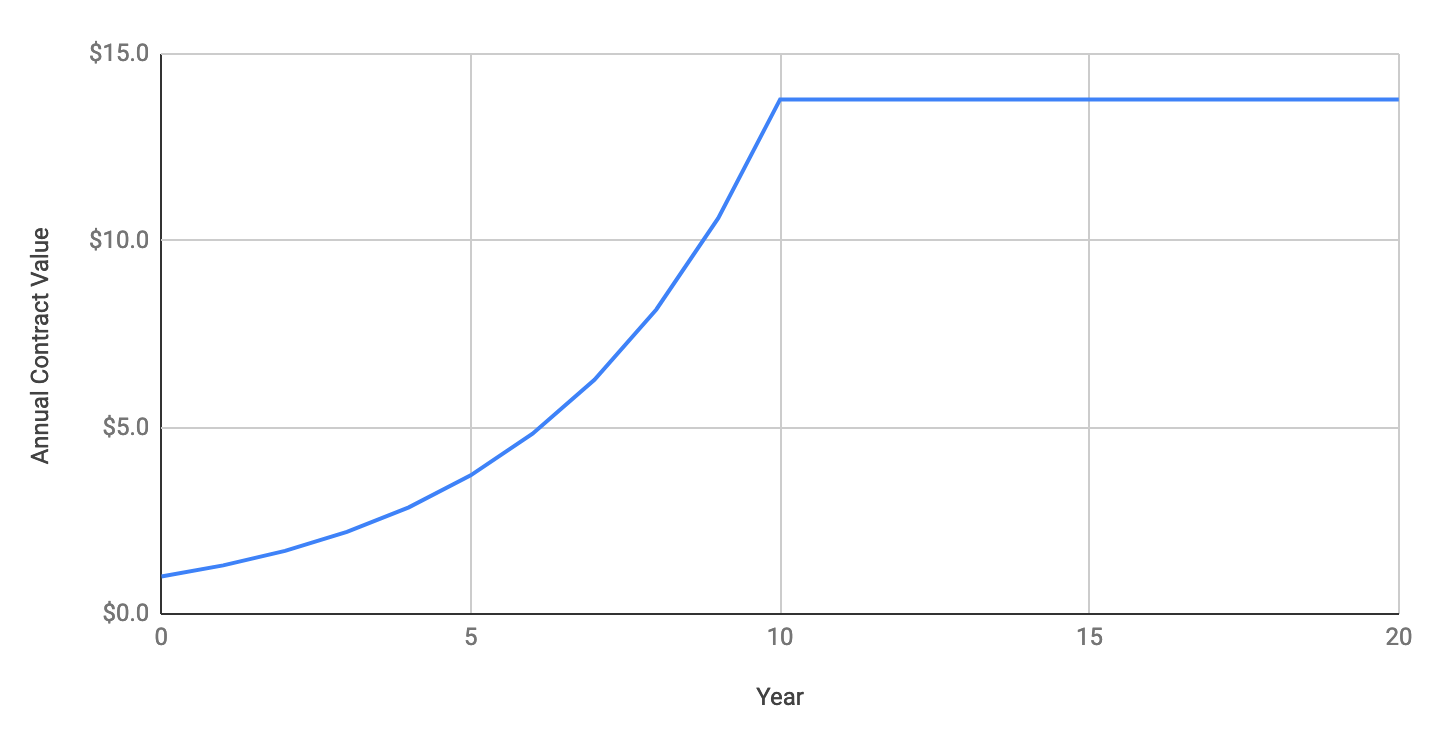

- Imagine we acquire a cohort of customers who pay an annual amount growing or contracting at some constant yearly rate, which represents our revenue retention

- Let’s assume this expansion or contraction continues for 10 years, after which the revenue collected flattens out

- Lastly, we assume some discount rate or cost of capital, which we will use to discount the value of those payments back to the present

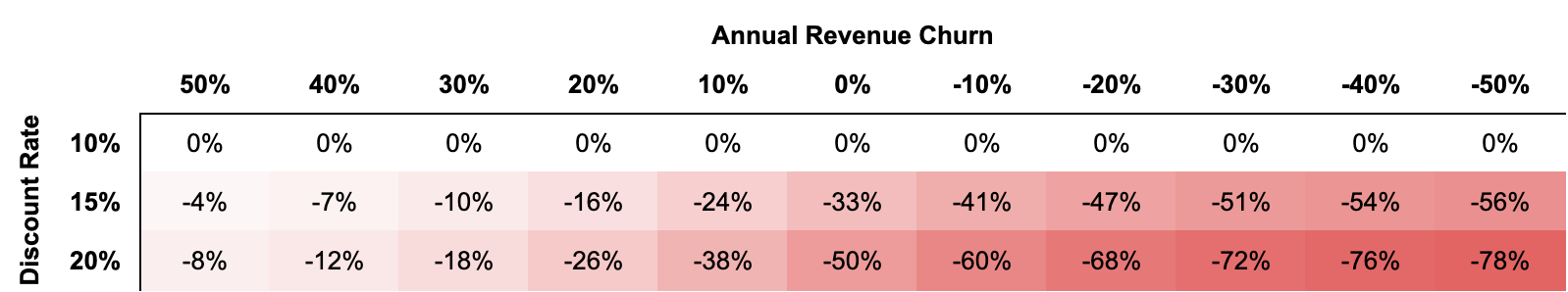

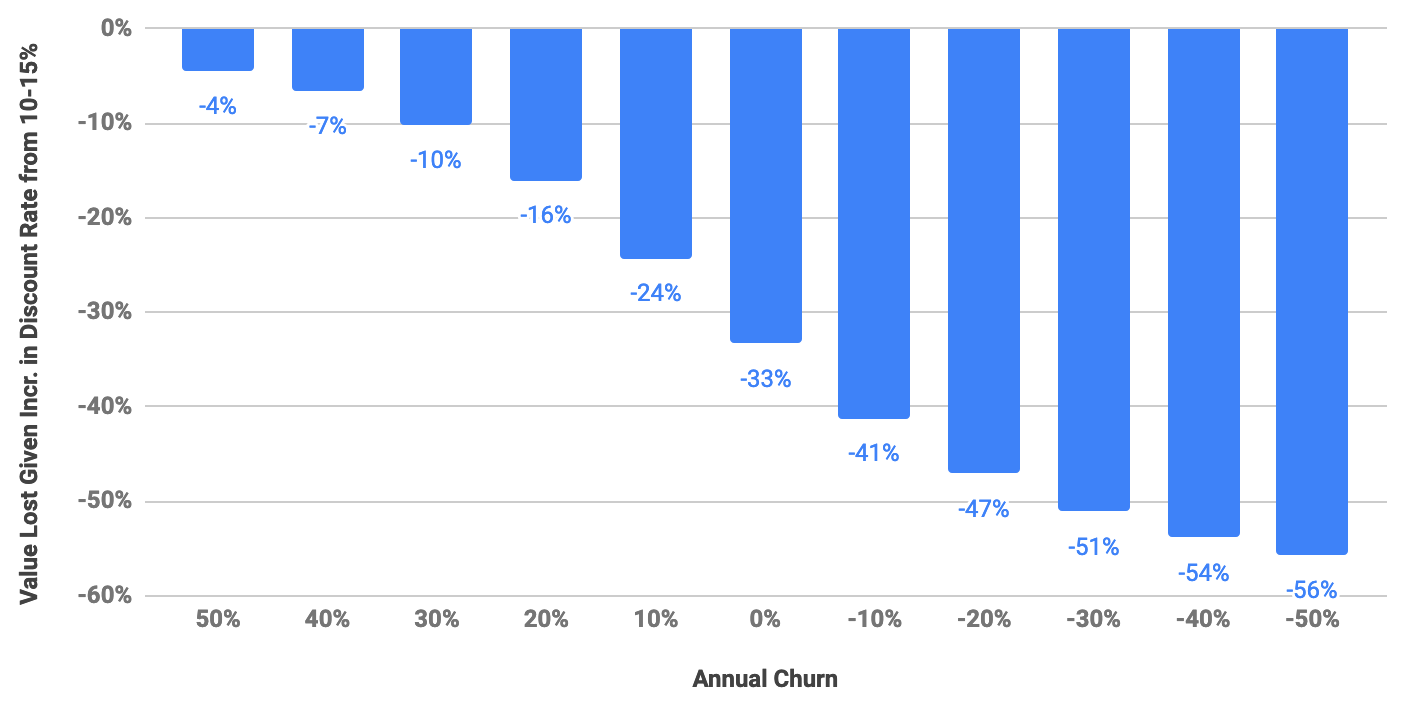

Now we ask the question: assuming a base discount rate of 10%, how would an increase to 15% or 20% impact the present value of the cohort’s revenue stream?

The answer is quite dramatic:

For a company with strong net retention of 130% (-30% revenue churn), an increase in discount rate from 10 to 15% cuts the company’s valuation in half.

Notice how a company with 30% annual revenue churn only sees a 10% impact from a similar change in discount rate. This reflects the non-linear impact of the discount rate with respect to retention described earlier:

Theory → Reality

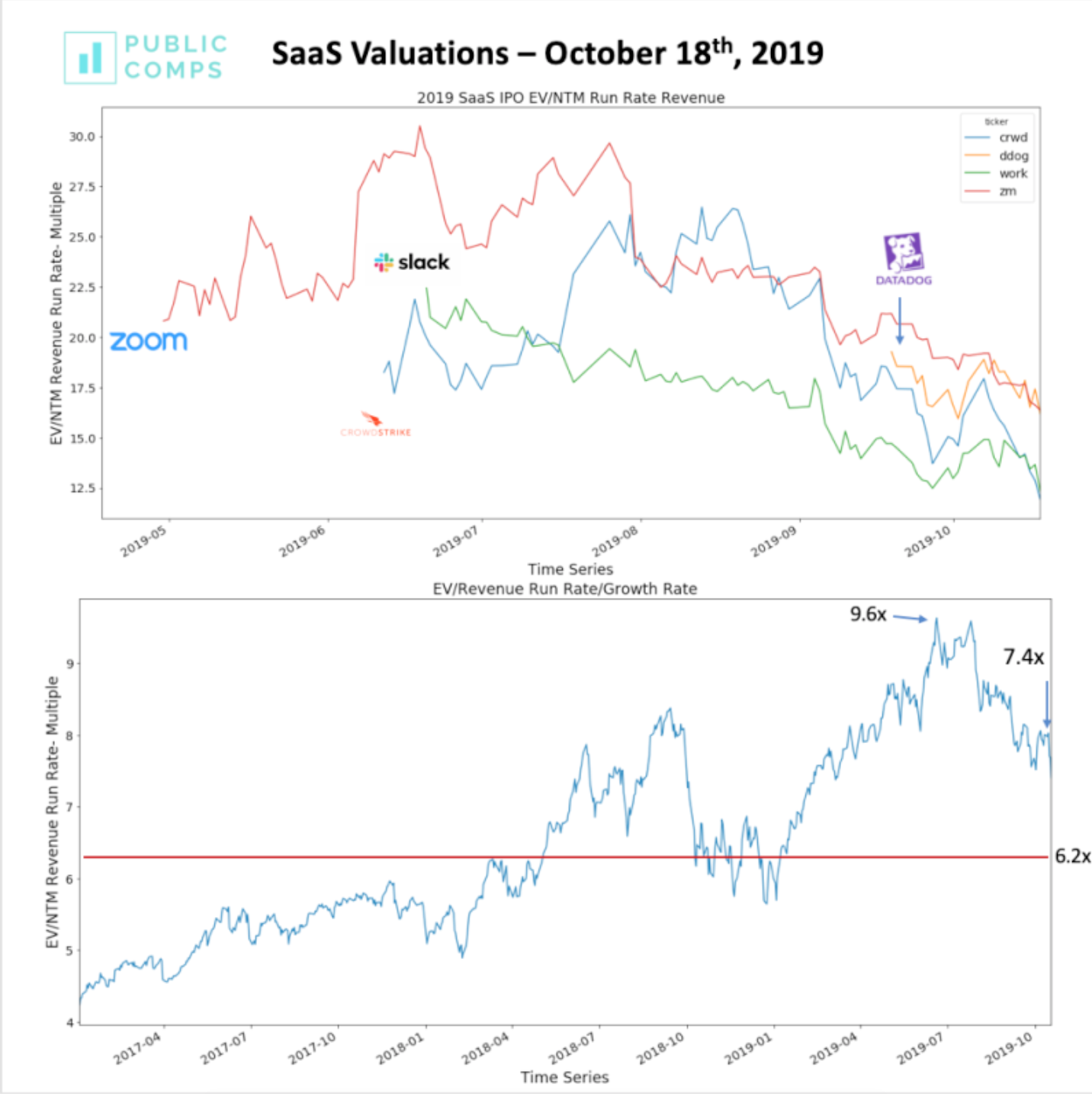

Many SaaS companies have gone public this year with strong net retention metrics of 100%+.

In recent months, however, these same companies have seen their valuations tank, often without any meaningful changes in operational performance.

While some point to this as an example of the “WeWork Effect”, these business are so fundamentally different in both business models and business performance that WeWork’s troubles cannot possibly explain these haircuts.

Let’s go a level deeper. If lower churn leads to higher volatility we should be able to see it in the data.

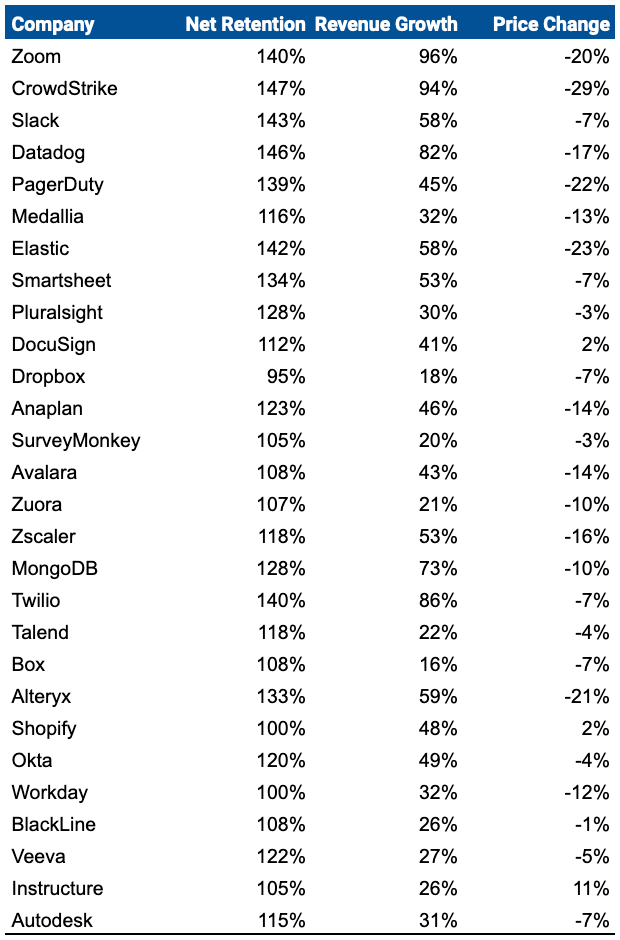

I assembled the following set of SaaS stocks, finding their latest revenue growth and net retention data, along with the price decline they saw from 9/21 to 10/21.

If the theory is true, we should see companies with higher net revenue retention declined further in the recent valuation pullback.

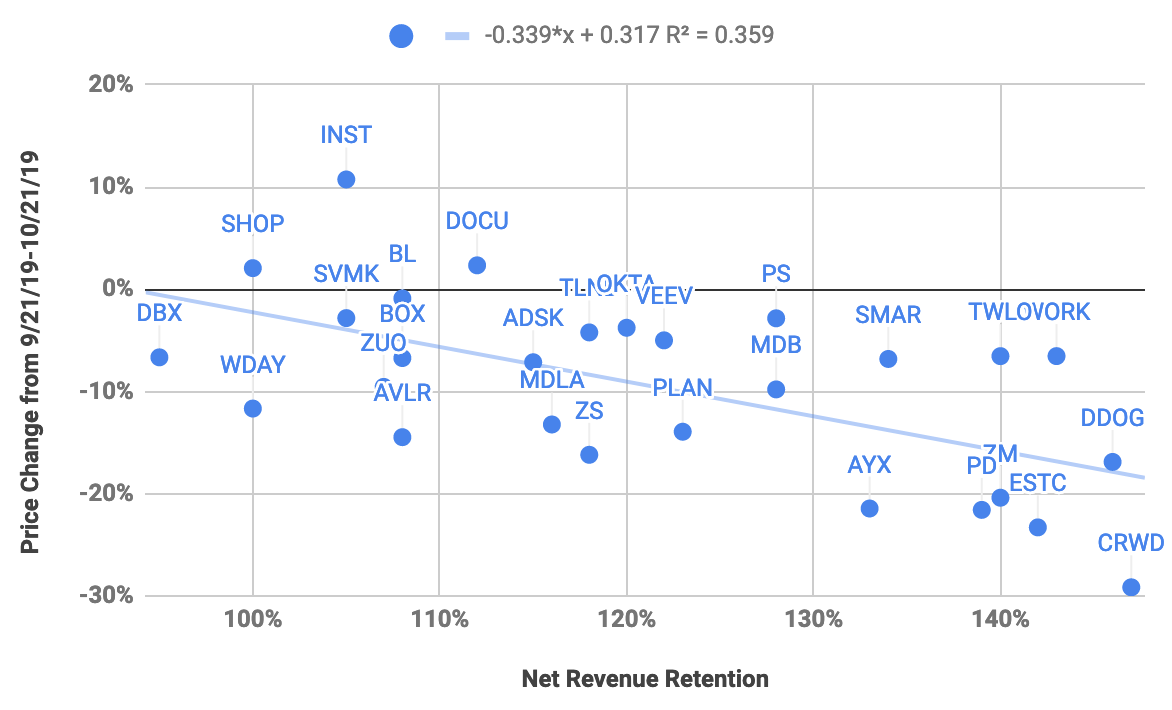

That’s exactly what we see:

Higher revenue retention, bigger valuation cut. On average, 10% higher retention lead to an additional 3.4% decline in price. The relationship is statistically significant at p < 0.05 (in case you were wondering), and the "low" R-squared of 0.36 simply means you can't explain all of the variation in or predict the level of price change using only this single variable, despite the strong relationship. Given public stock movements are notoriously difficult to predict, this is not surprising.

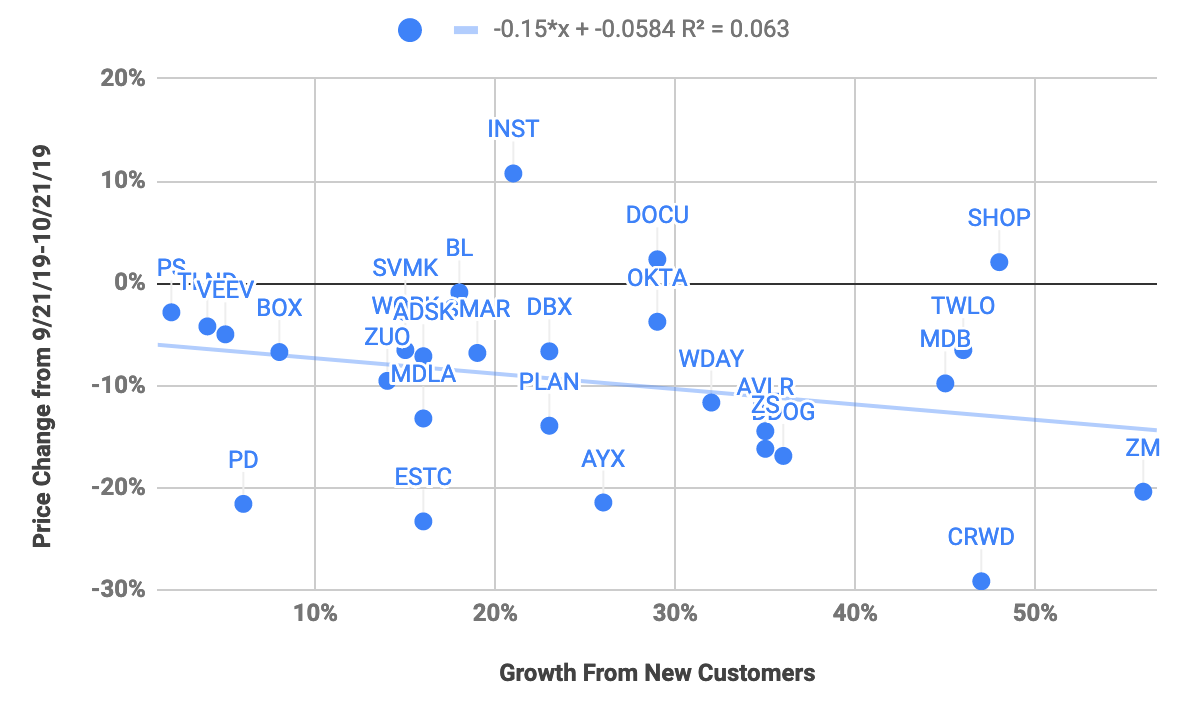

And for good measure, if we decompose overall growth and examine the component reflecting only the addition of new customers (1 + overall growth - net retention), we see little correlation with the recent movement in SaaS stocks:

It’s all about retention

Both in theory and in practice, better retention drives higher volatility.

Why does this matter?

The Federal Reserve recently cut interest rates for the third time this year.

The era of low interest rates won't last. If interest rates or the cost of capital spike, SaaS valuations will necessarily decline.

Keep this is mind when evaluating high-flying SaaS investments or the value of your company's equity: those with the best retention metrics will see the biggest drops.

If you want to comment, like or share this post you can use this tweet:

With great retention... comes great volatility 💣

— Nnamdi Iregbulem (@whoisnnamdi) November 4, 2019

Volatility increases as SaaS revenue retention improves 📈

Retention is therefore a double-edge sword ⚔️

How and why companies with strong revenue retention see the greatest volatility 📉:https://t.co/RIPIjngWPs

Receive my new long-form essays

Thoughtful analysis of the business and economics of tech